The majority of financial transactions are electronic, whether you’re buying an item or paying for a service. People don’t have to carry cash in their wallets to access their funds, eliminating the risk of immediate loss from pickpocketing or mugging. Credit and debit cards take up less space, are encrypted for security, and all major businesses accept them. Client management software for accounting firms also should have this capability to protect their financial information and give their clients peace of mind.

(Leelo Thefirst/Pexels)

How It Works

All credit and debit cards have either a magnetic strip or a microchip embedded in the plastic, which stores your client’s identification, bank account number, and routing information. The card reader sends a signal to your client’s bank account, verifying they have the necessary funds. Then, money is transferred from their bank account into your business account before it sends confirmation to both parties. No money changes hands, so there is no need to risk the liability of making bank deposits after work.

Why Is It Necessary?

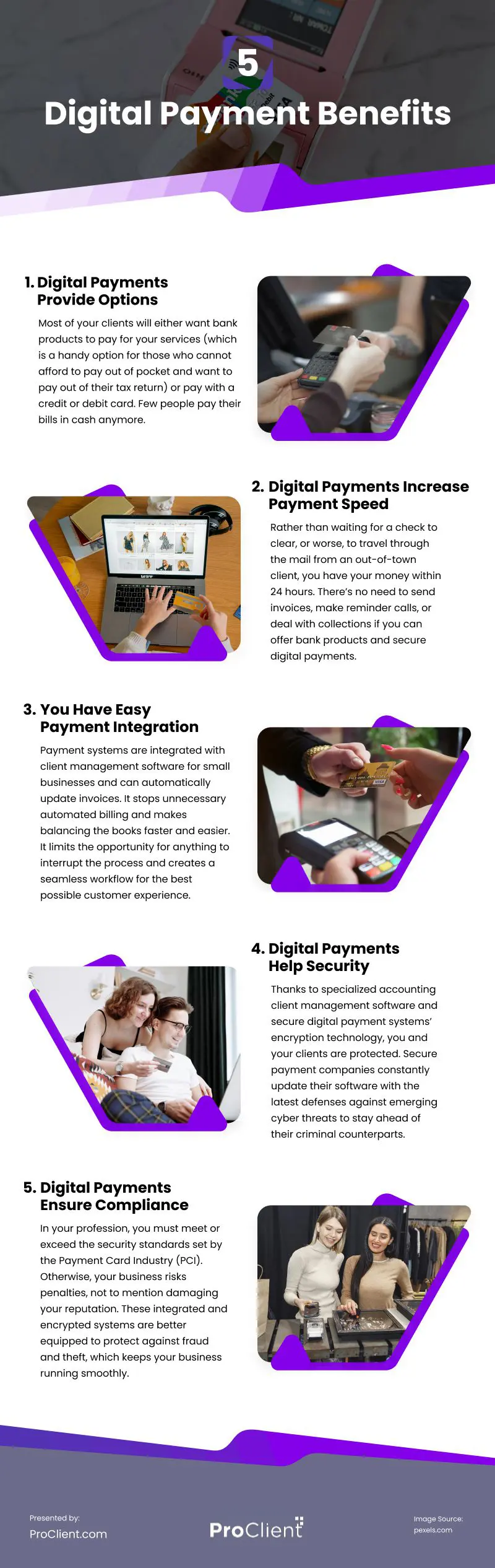

You may ask yourself if this feature is really necessary. Here are five reasons why secure payments are beneficial:

1. Digital Payments Provide Options

Most of your clients will either want bank products to pay for your services (which is a handy option for those who cannot afford to pay out of pocket and want to pay out of their tax return) or pay with a credit or debit card. Few people pay their bills in cash anymore. Other options include:

- Electronic Card Payments: This is the preferred method since you process payments on the spot. You can accept electronic payments in your office or through the client portal for clients who can’t be there in person.

- Checks: They are a possibility, but you run the risk of bounced checks and collections processes, which leaves a bad taste in everyone’s mouth. The exception would be e-checks, which process much like a debit card.

By offering digital options, you receive payments faster and without as much risk of theft or fraud. Clients appreciate the flexibility and efficiency of electronic payments. They may not notice it if you have the option. However, they will notice if you don’t.

2. Digital Payments Increase Payment Speed

Rather than waiting for a check to clear, or worse, to travel through the mail from an out-of-town client, you have your money within 24 hours. There’s no need to send invoices, make reminder calls, or deal with collections if you can offer bank products and secure digital payments.

3. You Have Easy Payment Integration

Payment systems are integrated with client management software for small businesses and can automatically update invoices. It stops unnecessary automated billing and makes balancing the books faster and easier. It limits the opportunity for anything to interrupt the process and creates a seamless workflow for the best possible customer experience.

4. Digital Payments Help Security

According to the IC3 Annual Report, in 2018, there were 351,937 reported cyber crimes with $2.7 billion stolen. That number more than doubled by 2022, when there were 800,944 crimes leading to $10.3 billion in stolen funds.

Online payments transmit personal information, credit card numbers, and bank account numbers. That information would be a prime target for hackers and thieves. Thanks to specialized accounting client management software and secure digital payment systems’ encryption technology, you and your clients are protected. Secure payment companies constantly update their software with the latest defenses against emerging cyber threats to stay ahead of their criminal counterparts.

Customers expect businesses to protect their financial information by purchasing the proper security. By installing secure payment software, you’re building trust between you and your clients and protecting your business.

To verify you’re purchasing the right digital payment service, ensure it has a secure sockets layer (SSL) certificate (also called Transport Layer Security TLS), which proves the site’s authenticity and encrypted connections. Clients making payments through their client portal should see a padlock next to the address bar, which tells them it is safe to proceed.

5. Digital Payments Ensure Compliance

In your profession, you must meet or exceed the security standards set by the Payment Card Industry (PCI). Otherwise, your business risks penalties, not to mention damaging your reputation. These integrated and encrypted systems are better equipped to protect against fraud and theft, which keeps your business running smoothly. Look for the highest designation possible, a PCI-DSS Level 1 certified or compliant system.

Currently, it is nearly impossible to get ahead or even keep up without adapting to emerging technology. While you may be hesitant to adopt the latest and greatest, electronic payments have been around for years. Secure digital payments integrated with accounting firm practice management software is the safest and most efficient way to do business. Let technology help lighten the load this tax season.

Video

Infographic

Electronic financial transactions are gaining popularity. Most businesses prefer credit and debit cards due to their convenience and encryption. Accounting firms should implement secure payment options to protect their client’s financial information and give them peace of mind. Check out the infographic to learn five reasons why secure payments are beneficial.