Accounting firms thrive on effective collaboration. When team members work together seamlessly to handle client accounts, track deadlines, and share financial data, the entire practice benefits. However, collaboration is only as good as the systems supporting it.

Without proper tools, accounting teams face persistent challenges: miscommunications cause errors, deadlines slip through the cracks, and teams isolate valuable data in silos. This is where accounting firm practice management software makes a critical difference.

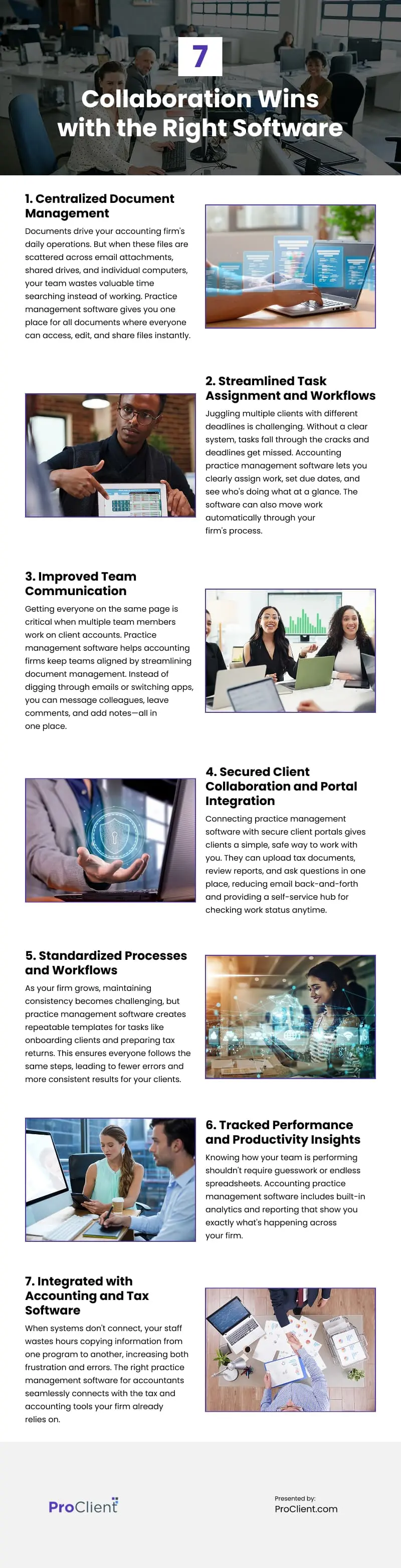

With practice management software, you can expect:

1. Centralized Document Management

Documents drive your accounting firm’s daily operations. Tax returns, financial statements, and client agreements are your bread and butter. But when these files are scattered across email attachments, shared drives, and individual computers, your team wastes valuable time searching instead of working.

Practice management software gives you one place for all documents where everyone can access, edit, and share files instantly. Security settings keep sensitive information protected while version control ensures nobody works on outdated documents. Your team spends less time managing files and more time serving clients.

2. Streamlined Task Assignment and Workflows

Juggling multiple clients with different deadlines is challenging. Without a clear system, tasks fall through the cracks and deadlines get missed. Accounting practice management software lets you clearly assign work, set due dates, and see who’s doing what at a glance.

The software can also move work automatically through your firm’s process. When a staff accountant finishes preparing a tax return, the right reviewer gets notified immediately. This cuts down on back-and-forth emails and helps everything move smoothly from start to finish.

3. Improved Team Communication

Getting everyone on the same page is critical when multiple team members work on client accounts. Instead of digging through endless email chains or jumping between different apps, practice management software functions as powerful document management software for accounting firms. You can message colleagues, leave comments, and add notes directly on client files—all in one place.

This cuts down on response delays and makes sure important messages don’t slip through the cracks. Your team can tag each other on documents, share updates instantly, and even jump on video calls without leaving the platform. Whether your staff works from the office, home, or both, everyone stays in the loop without the usual communication headaches.

4. Secured Client Collaboration and Portal Integration

Working with clients shouldn’t mean endless email attachments and phone tag. Modern accounting firms need a better way to share sensitive files and get quick approvals. Traditional email just doesn’t cut it anymore—it’s not secure enough and files get lost too easily.

By connecting practice management software for accountants with secure client portals, you give clients a simple, safe way to work with you. They can upload tax documents, review reports, and ask questions in one secure place. This cuts down on back-and-forth emails and gives clients a self-service hub where they can check on their work status whenever they want (even outside business hours).

5. Standardized Processes and Workflows

As your firm grows, keeping everyone working the same way becomes challenging. When each accountant has their own approach to tasks like preparing returns or onboarding clients, quality suffers and mistakes happen more often.

Accounting firm practice management software solves this by creating repeatable templates for everything from onboarding new clients to preparing tax returns. Everyone follows the same steps every time, which means fewer errors and more consistent results for your clients.

This approach also makes training new team members much easier. Instead of shadowing senior staff for weeks, new hires can follow clear, step-by-step workflows that guide them through each process correctly.

6. Tracked Performance and Productivity Insights

Knowing how your team is performing shouldn’t require guesswork or endless spreadsheets. Traditional tracking methods eat up valuable time and often give you stale information when you need real answers.

Accounting practice management software includes built-in analytics and reporting that show you exactly what’s happening across your firm. You can quickly see who’s completing tasks on time, which projects are falling behind, and where your team excels or struggles—all at a glance.

When you spot patterns, like certain tax forms consistently taking longer than usual, you can fix problems before they affect clients. Having real numbers at your fingertips helps you make better decisions about staffing, training, and process improvements that actually boost your bottom line.

7. Integrated with Accounting and Tax Software

Your practice management system shouldn’t exist in its own bubble. It needs to talk to the tax and accounting software your team uses every day. When systems don’t connect, your staff wastes hours copying information from one program to another, increasing both frustration and errors.

The right practice management software for accountants seamlessly connects with the tax and accounting tools your firm already relies on. This creates a workflow where client details, financial data, and tax information flow automatically between systems. When someone updates client information in one place, it updates everywhere, keeping your entire practice in sync.

Increase Collaboration with Practice Management Software

Implementing accounting practice management software creates a true collaboration hub for your firm. Instead of working in disconnected systems and communication channels, your team gains a unified platform where they can access documents, communicate about client work, and follow standardized processes.

With collaboration at the center of your practice, you can serve more clients effectively without increasing your team’s workload. Watch as your firm handles tax seasons with less stress, onboards new clients more smoothly, and resolves complex financial challenges more efficiently.

Video

Infographic

Accounting firms thrive on teamwork for accurate and timely service. Without the right tools, miscommunication and missed deadlines can occur. Practice management software transforms modern firms, ensuring efficiency and collaboration. Learn more in this infographic.