Staring at next quarter’s workload, you already feel the familiar tax season panic setting in. Too many clients, too few hands, and the constant fear of dropping the ball keep you up at night.

Every year, firms watch their careful planning crumble under the avalanche of last-minute tax work. With 2025’s expanded standard deductions and the IRS Direct File program reaching more states, you’re bracing for even more complex client questions while your team is already stretched thin.

The good news? You can flip the script on tax season chaos. Below are some battle-tested strategies to help you master your firm’s capacity, keep your team sane, and make this year’s filing season your most profitable yet.

What is Capacity Planning in Accounting?

Capacity planning tells you whether your firm can handle its workload without burning out. You look at your people, your systems, and your time, then match these against the mountain of work heading your way.

A solid capacity plan works like your firm’s early warning system. You’ll know months in advance if you need more staff, better tools, or fewer clients. No more last-minute scrambles or painful client conversations.

Most firms drown in tax season because they never did the math on what they could actually handle. Good capacity planning helps you optimize workloads and plan resources effectively.

7 Ways to Plan Your Firm’s Capacity for Tax Season

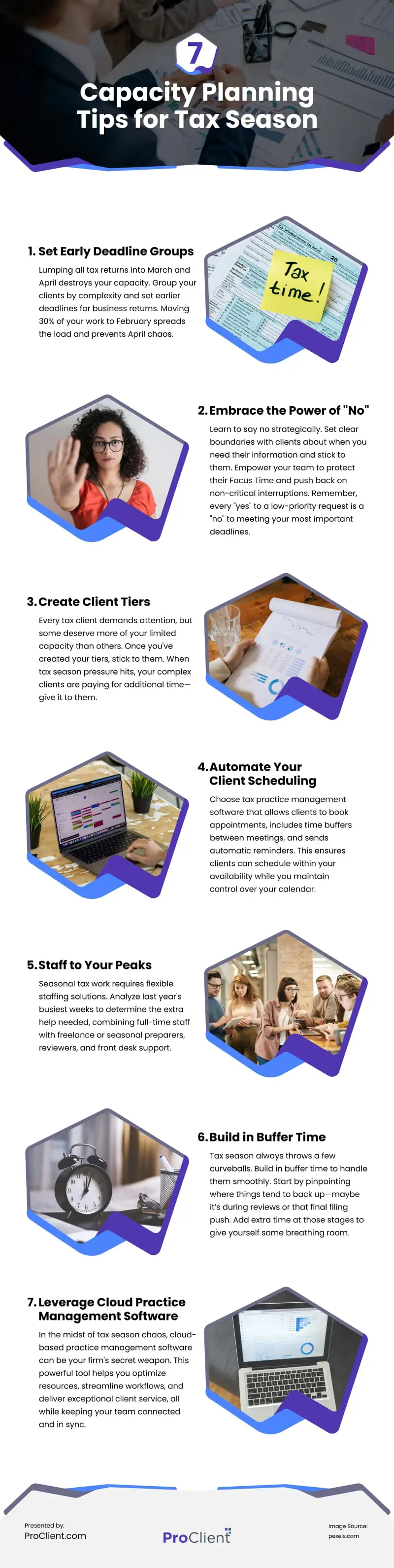

1. Set Early Deadline Groups

Lumping all tax returns into March and April destroys your capacity. Group your clients by complexity and set earlier deadlines for business returns. Moving 30% of your work to February spreads the load and prevents April chaos.

Early deadlines work when you back them with clear benefits. Offer priority service or fee discounts for February filing. Clients who meet early deadlines get faster turnaround and more attention. Those who wait fill your remaining capacity during crunch time.

2. Embrace the Power of “No”

Tax season brings a flood of last-minute requests, from clients who “just need one more form” to colleagues who “have a quick question.” While the urge to be helpful is admirable, always saying yes will sink your capacity plan faster than an iceberg sank the Titanic.

Learn to say no strategically. Set clear boundaries with clients about when you need their information and stick to them. Empower your team to protect their Focus Time and push back on non-critical interruptions. Remember, every “yes” to a low-priority request is a “no” to meeting your most important deadlines.

3. Create Client Tiers

Every tax client demands attention, but some deserve more of your limited capacity than others. For example, your corporate returns need deeper analysis than basic 1040s, while international clients require more planning than local retirees.

Below are some example tiers you can create:

- Complex: Companies with $5M+ revenue, international tax needs

- Priority: Small businesses, real estate investors, complex individuals

- Standard: W2 employees with investments, simple Schedule C

- Basic: Single-source income, standard deduction filers

Pro Tip: Once you’ve created your tiers, stick to them. When tax season pressure hits, your complex clients are paying for additional time—give it to them.

4. Automate Your Client Scheduling

Every unexpected client call and impromptu meeting saps your tax season capacity. Without a structured scheduling system, your team wastes hours on back-and-forth emails and unexpected interruptions.

Look for tax practice management software that lets clients book their own appointment slots, adds in time buffers between meetings, and automatically sends reminders. When clients can schedule meetings within your predefined availability windows, you maintain control of your calendar while giving them the access they need.

5. Staff to Your Peaks

Seasonal surges in tax work demand flexible staffing solutions. Your core team might handle the regular workload fine, but tax season needs extra hands. Look at your busiest weeks from last year and calculate the additional help you’ll need.

Consider a mix of full-time staff, some freelance or seasonal preparers and reviewers, and even extra front desk coverage. Each role should align with specific workload spikes. For example, you might need more preparers in February and March but more reviewers in March and April. Build your staffing plan around these peaks to streamline capacity and prevent burnout.

6. Build in Buffer Time

Tax season always throws a few curveballs. Build in buffer time to handle them smoothly.

Start by pinpointing where things tend to back up—maybe it’s during reviews or that final filing push. Add extra time at those stages to give yourself some breathing room.

You’ll also want to adjust these buffers as the season progresses. Track where delays pop up and shift time as needed so your team stays ready for whatever comes their way.

7. Leverage Cloud Practice Management Software

In the midst of tax season chaos, cloud-based practice management software can be your firm’s secret weapon. This powerful tool helps you optimize resources, streamline workflows, and deliver exceptional client service, all while keeping your team connected and in sync.

Imagine having a real-time, bird’s-eye view of your firm’s capacity and workload. With cloud-based practice management software, you can:

- Assign and track tasks, ensuring balanced workloads across your team

- Monitor project progress and identify potential bottlenecks before they become critical

- Access client data securely from anywhere, enabling seamless remote work

- Integrate with your existing tax and accounting software for a unified, efficient workflow.

Bonus Tip: Develop a Contingency Plan

Unexpected events—like a sudden team member’s absence—can reduce capacity during tax season. Develop a contingency plan that includes backup staff or on-call team members who can assist if someone becomes unavailable.

One way to create a solid contingency plan is by partnering with staffing agencies specializing in accounting. They can provide qualified temporary or seasonal staff at short notice, ensuring you have skilled professionals ready to step in.

Final Thoughts

These are some essential strategies to set your firm up for tax season success. Remember, effective capacity planning means giving your team the tools and structure they need to handle peak workloads without feeling overwhelmed. Determine what needs attention and establish a plan that keeps everything steady when demand peaks.

Video

Infographic

Many firms struggle during tax season due to inadequate capacity assessments. Proper planning optimizes workloads and resource allocation. Discover this infographic for essential capacity planning tips for tax season.