When you think about cloud-based tax document management solutions for accountants, you probably wonder if they’re as efficient as they claim to be. You may have heard stories like:

- “Cloud storage is too risky—your documents could disappear overnight.”

- “Switching to digital is a hassle and more expensive than it’s worth.”

- “Only large companies benefit from these solutions, not small businesses.”

But these stories are just that—stories. In this blog, we debunk common misconceptions about these solutions and explore their real benefits. By the time you’re done reading, you’ll have a clear understanding of whether an online tax document management system is right for you.

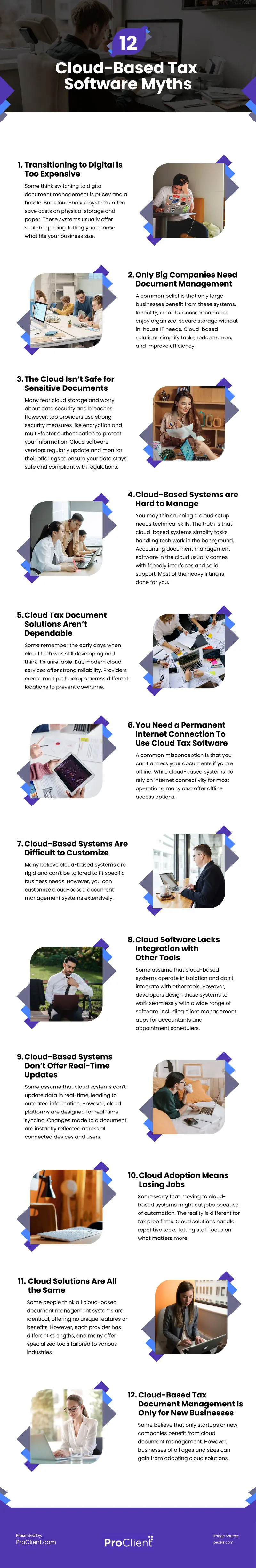

Myths Surrounding Cloud-Based Tax Document Management Software

1. Transitioning to Digital is Too Expensive

Some think switching to digital document management is pricey and a hassle. But, cloud-based systems often save costs on physical storage and paper. These systems usually offer scalable pricing, letting you choose what fits your business size. By avoiding hefty upfront costs, you can smoothly transition without breaking the bank.

2. Only Big Companies Need Document Management

A common belief is that only large businesses benefit from these systems. In reality, small businesses can also enjoy organized, secure storage without in-house IT needs. Cloud-based solutions simplify tasks, reduce errors, and improve efficiency. They give businesses of all sizes the tools to handle documents better and grow effectively.

3. The Cloud Isn’t Safe for Sensitive Documents

Many fear cloud storage and worry about data security and breaches. However, top providers use strong security measures like encryption and multi-factor authentication to protect your information. Cloud software vendors regularly update and monitor their offerings to ensure your data stays safe and compliant with regulations. This means you can trust your documents are well-protected.

4. Cloud-Based Systems are Hard to Manage

You may think running a cloud setup needs technical skills. The truth is that cloud-based systems simplify tasks, handling tech work in the background. Accounting document management software in the cloud usually comes with friendly interfaces and solid support. Most of the heavy lifting is done for you.

5. Cloud Tax Document Solutions Aren’t Dependable

Some remember the early days when cloud tech was still developing and think it’s unreliable. But, modern cloud services offer strong reliability. Providers create multiple backups across different locations to prevent downtime. Even during disruptions, like a power outage, business document management software for accountants can keep running smoothly.

6. You Need a Permanent Internet Connection To Use Cloud Tax Software

A common misconception is that you can’t access your documents if you’re offline. While cloud-based systems do rely on internet connectivity for most operations, many also offer offline access options. This ensures that critical documents can be accessed and worked on even when the internet is down.

7. Cloud-Based Systems Are Difficult to Customize

Many believe cloud-based systems are rigid and can’t be tailored to fit specific business needs. However, you can customize cloud-based document management systems extensively. Adjust features like document tagging, access controls, and workflow automation to suit the unique requirements of any accounting practice.

8. Cloud Software Lacks Integration with Other Tools

Some assume that cloud-based systems operate in isolation and don’t integrate with other tools. However, developers design these systems to work seamlessly with a wide range of software, including client management apps for accountants and appointment schedulers. Therefore, you can connect them to your existing tools to streamline your workflow and improve productivity.

9. Cloud-Based Systems Don’t Offer Real-Time Updates

Some assume that cloud systems don’t update data in real-time, leading to outdated information. However, cloud platforms are designed for real-time syncing. Changes made to a document are instantly reflected across all connected devices and users. This ensures everyone in your organization works with the most current data.

10. Cloud Adoption Means Losing Jobs

Some worry that moving to cloud-based systems might cut jobs because of automation. The reality is different for tax prep firms. Cloud solutions handle repetitive tasks, letting staff focus on what matters more. Employees can build better relationships with clients instead of getting stuck in endless paperwork. They can offer new services and find ways to grow the business. Automation frees them up to do the important work that keeps clients happy and business booming.

11. Cloud Solutions Are All the Same

Some people think all cloud-based document management systems are identical, offering no unique features or benefits. However, each provider has different strengths, and many offer specialized tools tailored to various industries. Whether you need automated workflows, integrated scheduling, or secure client portals, there’s a cloud solution designed to fit your specific needs.

12. Cloud-Based Tax Document Management Is Only for New Businesses

Some believe that only startups or new companies benefit from cloud document management. However, businesses of all ages and sizes can gain from adopting cloud solutions. Whether you’re an established firm looking to modernize or a new venture seeking efficiency, cloud-based systems offer tools that can streamline processes and support business growth.

Final Thoughts

Cloud-based tax document management systems aren’t as complicated as they seem. They offer tons of benefits for tax prep firms. You get to focus on client relationships and business growth. Explore your options today and see how a cloud-based solution can transform your firm’s efficiency and productivity.

Video

Infographic

You might doubt their efficiency when exploring cloud-based tax document management solutions for accountants. This infographic addresses common misconceptions and highlights the real benefits to help you determine if an online tax document management system is right for you.