Every successful accounting practice knows the pain of no-shows and last-minute cancellations. Studies show businesses lose over $26,000 annually due to missed appointments—money that could be invested back into serving clients better.

SMS reminders have emerged as the most effective solution to this costly problem. Unlike traditional methods like phone calls or emails that often go ignored, text messages often have a higher open rate and can help significantly reduce no-shows. With an automated messaging system for accountants, you can reclaim lost revenue while strengthening client relationships.

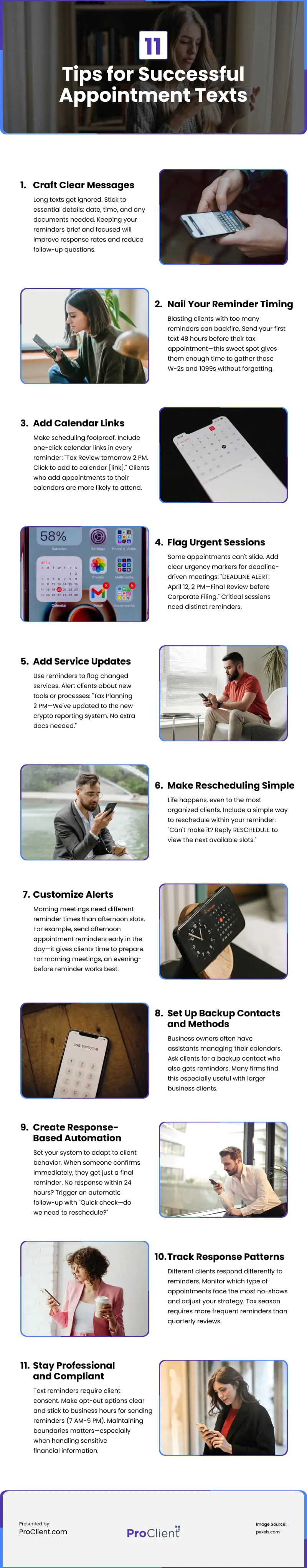

Let’s explore these 11 best practices that can help you maximize your appointment reminder system and keep your calendar running smoothly:

1. Craft Clear Messages

Long texts get ignored. Stick to essential details: date, time, and any documents needed. “Tax Review—March 15th, 2 PM. Bring last year’s returns + recent business statements. Virtual meeting link below.”

Busy professionals scan their messages in seconds. Keeping your reminders brief and focused will improve response rates and reduce follow-up questions.

2. Nail Your Reminder Timing

Blasting clients with too many reminders can backfire. Send your first text 48 hours before their tax appointment—this sweet spot gives them enough time to gather those W-2s and 1099s without forgetting.

For critical meetings like tax filing deadlines or yearly planning, add a gentle nudge 2 hours before. Your clients are busy professionals too, and this double-tap approach keeps you top of mind without being pushy.

3. Add Calendar Links

Make scheduling foolproof. Include one-click calendar links in every reminder: “Tax Review tomorrow 2 PM. Click to add to calendar [link].” Clients who add appointments to their calendars are more likely to attend.

Quick calendar integration reduces double bookings. Most clients appreciate easy ways to track their commitments.

4. Flag Urgent Sessions

Some appointments can’t slide. Add clear urgency markers for deadline-driven meetings: “DEADLINE ALERT: April 12, 2 PM—Final Review before Corporate Filing.” Critical sessions need distinct reminders.

Highlighting true urgency improves attendance for essential meetings. Clients respond better when they understand time sensitivity.

5. Add Service Updates

Use reminders to flag changed services. Alert clients about new tools or processes: “Tax Planning 2 PM—We’ve updated to the new crypto reporting system. No extra docs needed.” Preparation notes prevent day-of surprises.

Clear updates reduce last-minute cancellations. Clients arrive better prepared when they know about system changes.

6. Make Rescheduling Simple

Life happens, even to the most organized clients. Include a simple way to reschedule within your reminder: “Can’t make it? Reply RESCHEDULE to view the next available slots.” A flexible booking system keeps your schedule full and clients happy.

As soon as clients request to reschedule, send available options for the next three business days. Quick action maintains momentum and secures the rebooking.

7. Customize Alerts

Morning meetings need different reminder times than afternoon slots. For example, send afternoon appointment reminders early in the day—it gives clients time to prepare. For morning meetings, an evening-before reminder works best.

Additionally, tax season needs different reminder patterns than off-peak months. Increase message frequency during deadlines and adjust content for time-sensitive services: “Critical deadline approaching – confirm your April 10th appointment.”

Adapting your reminder strategy for peak periods helps maintain attendance when schedules get tight. Many firms see better show rates with season-specific messaging.

You can track which reminder times get the best response to help fine-tune your system. Most accounting firms see better attendance when they match reminder timing to appointment slots.

8. Set Up Backup Contacts and Methods

Business owners often have assistants managing their calendars. Ask clients for a backup contact who also gets reminders. Many firms find this especially useful with larger business clients.

Including authorized assistants or office managers in your reminder system reduces miscommunication and improves attendance rates.

Don’t rely solely on texts. Set up a combination of text and email reminders for critical appointments like tax deadlines or audit meetings. Some clients prefer email, and others respond better to texts.

Layered communication catches busy clients wherever they are. Using both channels increases the chances your reminder gets noticed.

9. Create Response-Based Automation

Set your system to adapt to client behavior. When someone confirms immediately, they get just a final reminder. No response within 24 hours? Trigger an automatic follow-up with “Quick check—do we need to reschedule?”

You can also program different paths based on replies. For example, set up instant rescheduling links for “NO” responses, prep checklists for “YES” replies, and extra reminders for “MAYBE” answers. Such automated response chains catch potential no-shows while they’re still preventable.

10. Track Response Patterns

Different clients respond differently to reminders. Monitor which type of appointments face the most no-shows and adjust your strategy. Tax season requires more frequent reminders than quarterly reviews.

Analyzing response patterns helps optimize your reminder system. Most firms find their attendance rates improve when they adapt timing and frequency based on appointment type and client history.

11. Stay Professional and Compliant

Text reminders require client consent. Make opt-out options clear and stick to business hours for sending reminders (7 AM-9 PM). Maintaining boundaries matters—especially when handling sensitive financial information.

Leading accounting firms protect their reputation by respecting communication preferences. Getting permission before starting text reminders and following privacy guidelines builds long-term trust.

Final Verdict

Every missed appointment costs your practice revenue and momentum. With these proven reminder strategies, you can cut no-shows and strengthen client relationships. Start implementing these best practices today to turn your schedule from unpredictable to reliable.

Video

Infographic

Every successful accounting practice faces the challenge of no-shows and cancellations. SMS reminders are an effective solution, as they have a higher open rate than phone calls or emails. Explore this infographic for eleven best practices to optimize your appointment reminder system and keep your calendar on track.