Businesses must store data for years, especially tax and client information. Tax audits can happen years after you file the return, and you may need to access client information if issues arise. As technology changes rapidly, however, it can be difficult to know how best to store information so it’s secure and recoverable.

Hardware solutions degrade over time, so it’s important to understand the different long-term storage options and make backups to prevent data loss. You may also encounter problems if your chosen technology becomes obsolete, and information can get corrupted after multiple migrations to new systems.

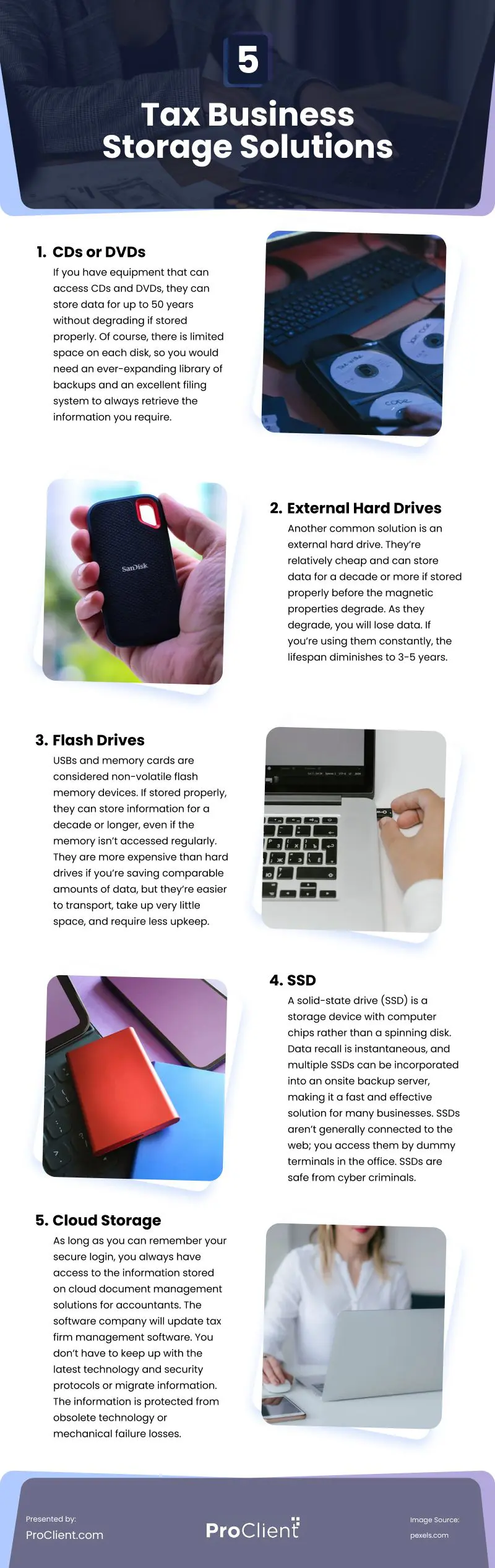

Storage Options

CDs or DVDs

If you have equipment that can access CDs and DVDs, they can store data for up to 50 years without degrading if stored properly. Of course, there is limited space on each disk, so you would need an ever-expanding library of backups and an excellent filing system to always retrieve the information you require.

Unfortunately, we’re already seeing the technology shift away from CDs and DVDs. Computers no longer have ports; you must buy additional equipment to play or record information on the disks. Like floppy disks, you may soon run out of options for retrieving data from CDs and DVDs. In fact, if you have information stored on disks, you may want to migrate the data to more popular technological solutions. If you have a lot of disks on file, it could take you a while to make the transfer.

External Hard Drives

Another common solution is an external hard drive. They’re relatively cheap and can store data for a decade or more if stored properly before the magnetic properties degrade. As they degrade, you will lose data. If you’re using them constantly, the lifespan diminishes to 3-5 years. If you’ve got automatic daily updates (which we recommend to prevent information loss), you may need to replace them more often.

Hard drives are delicate instruments with many moving parts. Handle them gently and always prepare them for shutdown before turning off the power. Use power strips to prevent power surges from damaging the drive, and transport them carefully. If you’re storing the hard drive, power up the system once a year to keep things running properly.

Flash Drives

USBs and memory cards are considered non-volatile flash memory devices. If stored properly, they can store information for a decade or longer, even if the memory isn’t accessed regularly. They are more expensive than hard drives if you’re saving comparable amounts of data, but they’re easier to transport, take up very little space, and require less upkeep.

When ejecting a flash drive, be sure to do so through the computer before pulling it from the port, as doing so can cause data corruption. By selecting “eject flash drive,” you ensure the computer is finished writing information on the drive and nothing stops mid-process causing complications. You can buy them as large as 512 GB or store data in smaller chunks. As with DVDs and CDs, you need a good filing system to know which drive has the data.

SSD

A solid-state drive (SSD) is a storage device with computer chips rather than a spinning disk. Data recall is instantaneous, and multiple SSDs can be incorporated into an onsite backup server, making it a fast and effective solution for many businesses. SSDs aren’t generally connected to the web; you access them by dummy terminals in the office. SSDs are safe from cyber criminals. However, onsite disasters could wipe out your whole system and it takes a while to create full backups.

SSDs last approximately three years with regular use, so there’s a higher turnover from device to device.

Cloud Storage

As long as you can remember your secure login, you always have access to the information stored on cloud document management solutions for accountants.

- The software company will update tax firm management software. You don’t have to keep up with the latest technology and security protocols or migrate information. The information is protected from obsolete technology or mechanical failure losses.

- You don’t have to worry about natural disasters wiping out all your data.

- Long-term storage is only as good as your system for backing up information regularly. Tax document management software will update your backup after every keystroke, so you always have the most current version saved for later.

The Best Option Is…

While there are several options for data storage, most technology degrades with time, and you have to physically transfer the data to newer devices before that happens or risk corrupted data. The company does all that for you using cloud-based tax management software, reducing your risk of losing important client data.

Video

Infographic

Businesses must store data securely for long periods. Understanding different long-term storage options and creating backups is essential to prevent data loss. Check out the infographic to explore tax business storage options.