With each new tax season, you’ll want to conduct an assessment of your systems and procedures to find where you can make improvements. Then you can hit the ground running when you begin providing your services.

Client document collection makes up a large part of the tax preparation process. Getting all the documents can end up being a huge time sink. But you don’t want to start preparation on a return before acquiring all of the client’s files. That’s going to lead to frustration!

So the big question is, how to best gather all the relevant documents? And how can you do it quickly while at the same time protecting your client’s data security?

The Traditional Method: Physical Collection

You don’t expect a client to bring over a sack full of receipts, files, and account statements for you to sort out in our digital age. It’s hard to think of an industry that hasn’t adopted electronic financial record keeping in some form.

Nevertheless, you may encounter some clients who prefer to keep their financial records on paper. That can be workable if their files are organized and complete. Even so, the physical transfer of paper documentation is generally less secure compared to electronic transfer.

If you have to collect physical documents, you can use tools to simplify the transfer of data for electronic tax preparation. You can scan the documents or get your client to scan them and send you the image files. Then you can run the scans through an application that can convert the images into electronic data you can input into the tax software.

Dealing with Scanned Documents

Scans are image files. That leads to an extra hurdle because tax software relies on text data entry. Not pictures!

You don’t want to end up re-entering the scanned data by hand into your system! You’re bound to have errors cropping up if you do that. It’s also going to take a lot of time.

For superior accuracy, scanned documents should be converted to digital PDF files. PDFs are widely employed in today’s business environment. These files are compatible with almost any type of tax software.

The Digital Method: Online Transfer

If your client has electronic records, then document collection will be a lot faster and simpler. First, you should ask the client what software they’re using and whether it runs on Windows, macOS, or something else.

Given that information, you can figure out the best way to transfer the client data to your tax preparation software. Your software provider should have a FAQ or knowledge base that can inform you whether the client files will be compatible or require conversion. They will also have info on how to accomplish the transfer.

You may be using professional tax software that features integration with your client’s accounting software. In that case, you will find it fairly easy to transfer the client data to your program. However, you may still need to run a verification to ensure that the data was transferred correctly.

You can also set up a client portal to let the client access a secure account for entering data and uploading files. The client documents will be stored in the cloud, accessible to you anyplace with an internet connection. You can download the files and load the info into your tax prep application.

These electronic methods are highly secure as the data can be protected via account passwords, two-factor authentication, and possibly data encryption.

Improving Efficiency of Collection

So the digital method is great, right? Digital transfer is comparatively fast, secure, and lossless compared to physical transfer. Clearly, you want to set up your office to enable digital transfer.

Hold up! Better keep in mind that digital transfer is not completely free of issues. You might not want to simply grab any ol’ professional tax software program off the shelf.

Not every program can provide a painless digital transfer experience, especially if that program requires some third-party cloud storage app to operate. When that’s the case, you might find the transfer process rather clunky.

Tax preparer software is not really designed to handle remote file transfers and file organization. Ideally, you’ll want to use a document management suite that specializes in collecting and storing files electronically.

Look no further than ProClient.

ProClient: A Winning Solution

ProClient is an ideal professional solution to make tax document collection hassle-free. It offers integration with Office 365 and Google Suite, applications that many of your clients would know and use. That makes it easy for them to send you files from these applications to ProClient.

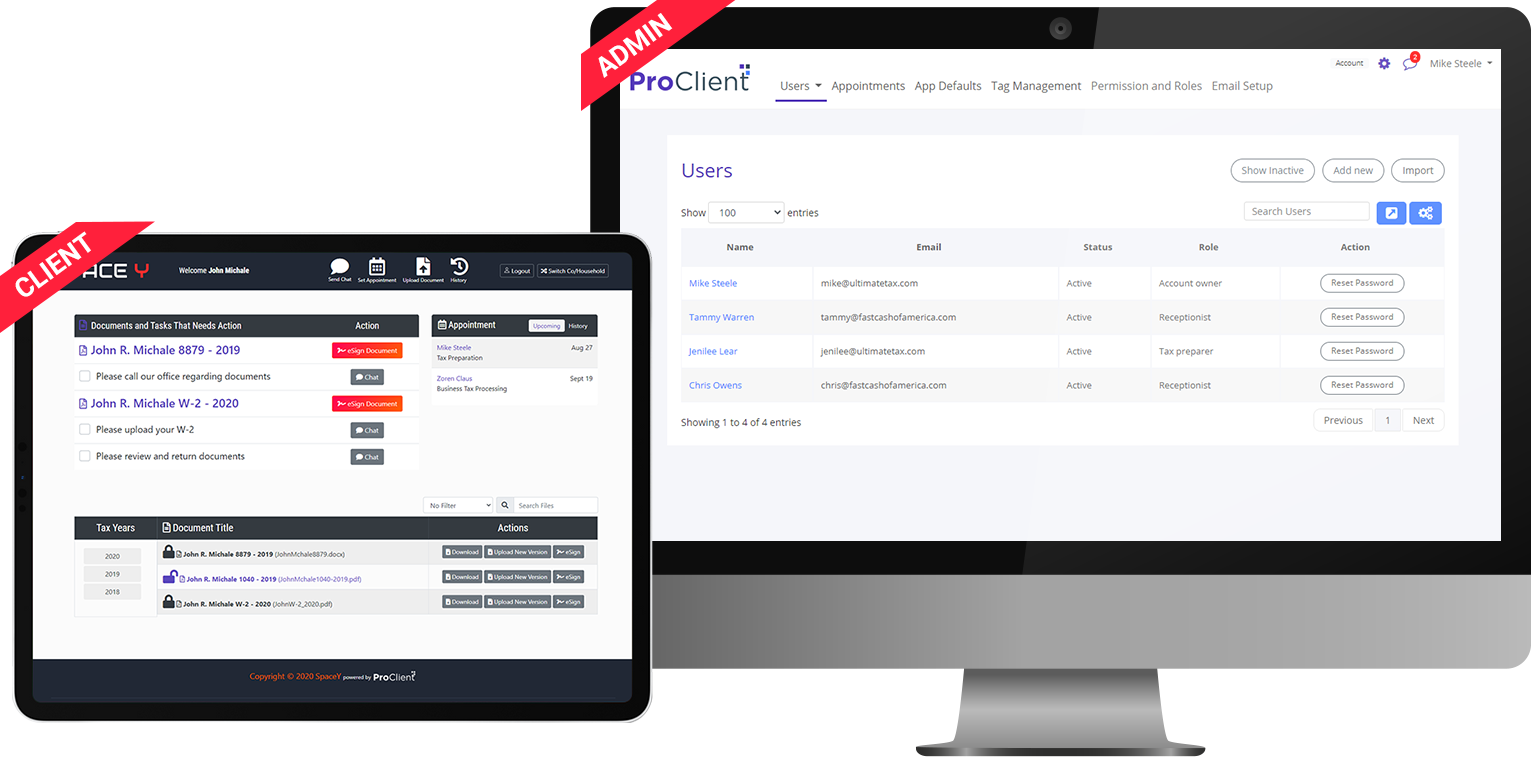

ProClient also gives you a Client Portal that you can customize with your branding and your own web domain. That will make them feel confident in using it and give your brand greater visibility.

Setting up the Client Portal is simple and quick. You can do it as easily as creating a client profile in the ProClient program. After you enter the client’s name and email address and save the profile, ProClient can automatically build an online portal for that client. No tedious website building involved!

ProClient will also send the client an email message automatically. The client will receive a link to the online portal. Clicking the link in the email sends them to the Client Portal.

A Powerful Document Management Suite

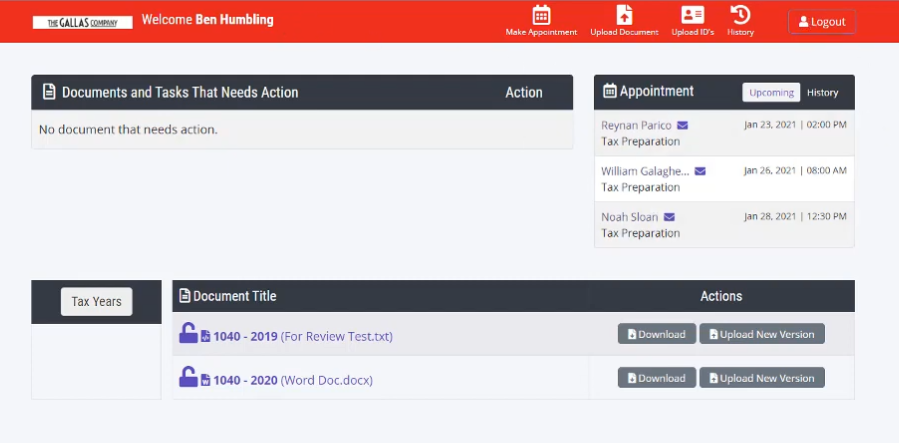

Once your client has access to the online portal, they can easily send you digital files. All they have to do is upload the file to the portal. It’s like moving a file from one folder to another on a desktop computer.

The client can also upload a scanned ID and enter the relevant data.

When the client uploads something via the portal, that file will be stored in the cloud. That means you can access it from anywhere, as long as you have an Internet connection.

What if you lose a document? No worries! The file is stored on the cloud, not on a local hard drive, where it can get corrupted or deleted. The cloud provides backup storage for documents. The files will be secure and safe.

With ProClient, you can do more than store the files. The software’s document management features include fast and easy file tagging, file version management, and file access management. Everything will be indexed, organized, and strictly under your control.

Collecting your clients’ tax documents can be an arduous and painstaking task. Don’t let it be that way! For an easier workflow and a more efficient office, get ProClient today.