Data security is a huge concern for any accounting business. The amount of private information that crosses your desk (or screen) is a serious temptation for hackers and thieves. If you look at a standard tax form, you have the client’s:

- Full Name

- Social Security Number

- Address

- Income Level

- Number of Dependents

- Bank Account Number (for either the refund deposit or to pay the IRS owed taxes)

- Physical and Financial Assets

- Phone Number

- Email Address

With this information, a criminal could apply for multiple high-limit credit cards or loans, print checks and spend money all over town, empty checking and savings accounts, and refinance your home. They could apply for business loans and credit cards with much higher limits than a personal account. They know where your wealthier clients live and whether they will likely have expensive artwork, tech gadgets, jewelry, tools, etc. They know if these clients have children they can exploit or if a business might have a kidnapping-for-ransom insurance policy on your client. They can ruin your client’s personal and business finances and credit for decades.

(rawpixel.com/Freepik)

Your Business Is Also At Risk

A breach of confidential data could damage your reputation in the community and cost you clients. It’s not just anonymous theft you must watch out for, as easy access to confidential information in the office might tempt employees who could misuse the data. You’d never know until multiple clients reported a loss. As it can take years for a victim to notice the damage, the potential harm is catastrophic. Remember that if your security doesn’t match the industry standard and you are found negligent, all your clients who suffered a loss due to the breach could sue your company for restitution.

The Solution

However, there is a solution that will save you future stress and potential lawsuits. The right client data management system will secure your business and safeguard your reputation. It will:

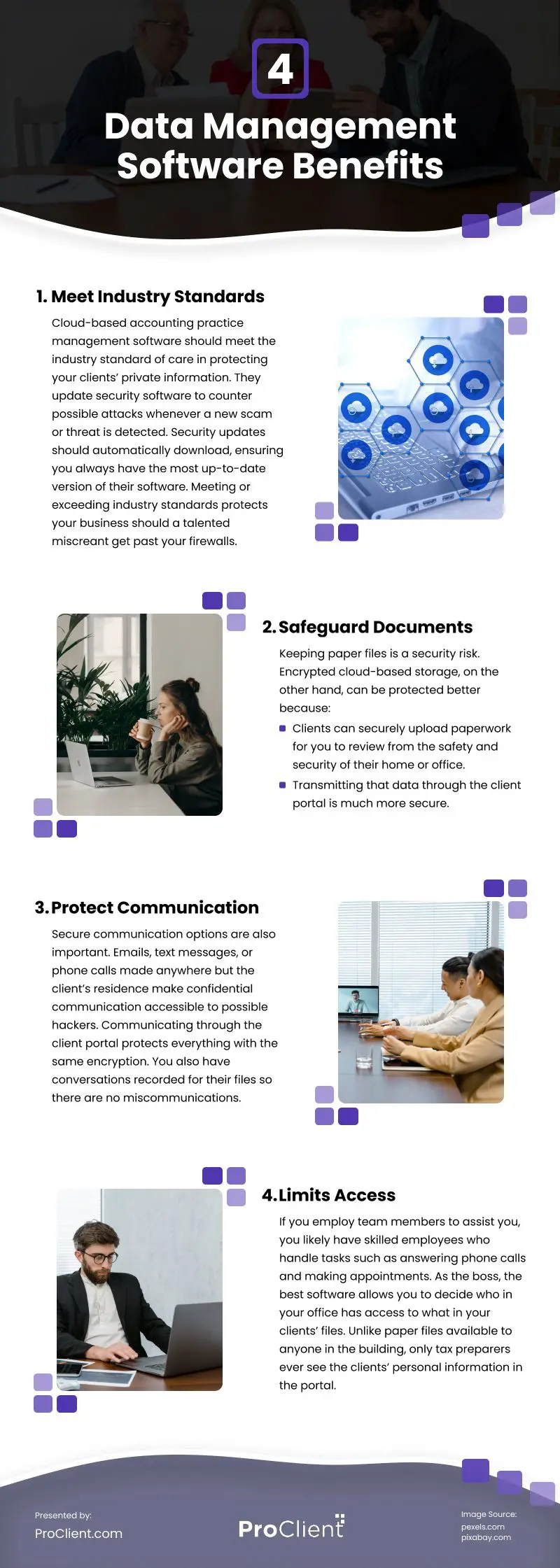

1. Meet Industry Standards

Cloud-based accounting practice management software should meet the industry standard of care in protecting your clients’ private information. They update security software to counter possible attacks whenever a new scam or threat is detected. Security updates should automatically download, ensuring you always have the most up-to-date version of their software. Meeting or exceeding industry standards protects your business should a talented miscreant get past your firewalls.

2. Safeguard Documents

Keeping paper files is a security risk. Encrypted cloud-based storage, on the other hand, can be protected better because:

- Clients can securely upload paperwork for you to review from the safety and security of their home or office. They keep the originals, preventing anything from happening to them. The data system is encrypted.

- Transmitting that data through the client portal is much more secure than sending it by fax (which gives anyone in the office access) or email, as most private email networks lack the security to protect them.

3. Protect Communication

Secure communication options are also important. Emails, text messages, or phone calls made anywhere but the client’s residence make confidential communication accessible to possible hackers. Communicating through the client portal protects everything with the same encryption. You also have conversations recorded for their files so there are no miscommunications.

4. Limits Access

If you employ team members to assist you, you likely have skilled employees who handle tasks such as answering phone calls and making appointments. As the boss, the best software allows you to decide who in your office has access to what in your clients’ files.

Unlike paper files available to anyone in the building, only tax preparers ever see the clients’ personal information in the portal. Conversely, the receptionist could access contact information and the calendar to make or cancel appointments, but it will limit client exposure.

The Human Factor Is The Weakest Link In Cyber Security

If you already have a system in place or are in the process of converting to one, ensure you have login protocols. A random, complicated password with two-step authentication is best. It would be best if your employees followed these guidelines in setting their passwords:

- Never write down passwords. It’s much easier to break into a desk than it is a security system like the one listed above.

- Never use a personal password on a business computer. People who use the same password across accounts may not need to write down their passwords, but Facebook and other social networks get hacked. People also list their employment, date of birth, and sometimes their address on their profile. They talk about their kids and pets. Many people use children or pet names as part of their passwords. Other popular choices include dates like an anniversary, zip codes, and social security numbers. It’s much easier to hack Facebook than your accounting management system.

- Make passwords complicated. Include upper and lower case letters, numbers, and special characters ($#!*). For example: Ex4mp!3

Accounting client management software isn’t just a convenience. It takes the guesswork out of security and safeguards your business and clients against regular and cyber crime. Investing in the right system will protect your clients’ financial well-being and strengthen your business. Put simply, it’s your commitment to security, efficiency, and peace of mind.

Video

Infographic

Data security is crucial for accounting businesses. A breach of confidential data could harm your reputation and lead to client loss. Implementing the right client data management system can secure your business and protect your reputation. Learn more in this infographic.