Traditional accounting processes can be such a headache. Think piles of paperwork, manual calculations, and endless data entry. No wonder accountants feel overwhelmed sometimes.

But things are changing thanks to digital advancements. Accounting firms today are embracing new tech to streamline their work (finally, right?).

What’s driving this digital adoption, and what are the leading technologies? Read on to find out.

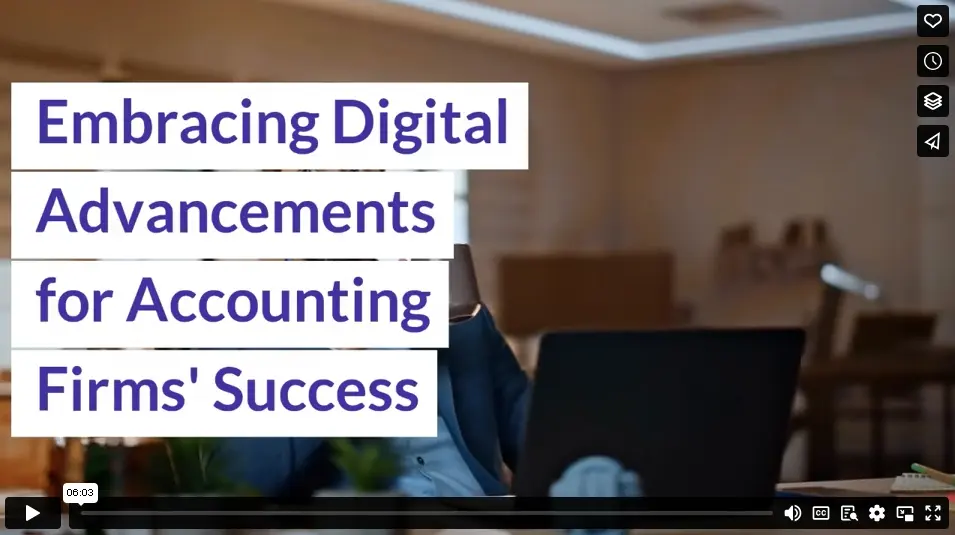

Cloud Computing

Cloud computing delivers services like storage, databases, software, and more over the internet. This tech gives you access to everything you need through any internet-connected device.

For accounting firms, it cuts down the hassle of managing IT infrastructure. You and your clients can access shared documents anytime, anywhere. The best part? It automates those tedious data entry tasks, letting you focus on more strategic projects.

Moreover, cloud computing:

- Improves data security by providing robust encryption and regular backups. Your sensitive information stays protected from breaches and data loss.

- Streamlines collaboration by allowing real-time access to documents. Teams can work together seamlessly, even from different locations.

- Reduces costs associated with physical servers and maintenance. Firms can invest those savings into growth and development instead.

- Offers scalability to easily adjust resources based on demand. You can expand or reduce your capacity without significant investment.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing accounting. These technologies simulate human intelligence and learn from data to automate tasks. They can handle repetitive work, freeing up your time for more strategic activities.

Accounting firms can use AI for audits, financial analysis, and tax planning. Machine learning can come in for automating transaction categorization, data entry, and account reconciliation. Together, AI and ML empower accountants to focus on higher-level decision-making and advisory roles.

Because AI can automate labor-intensive processes, it can lower labor costs while improving quality and reducing the risk of fraud. Consider using it for tasks like:

- Categorizing transactions

- Identifying data in scanned receipts or invoices

- Recording data in the correct formats

- Reconciling accounts against bank statements

- Streamlining audit processes or procedures

Blockchain

Blockchain is a digital ledger that records and distributes transactions across a network of computers. For accounting firms, this means more secure and accurate financial records. Imagine never having to worry about discrepancies in your ledgers—blockchain ensures every transaction is transparent and tamper-proof.

Blockchain can also lower the costs of maintaining and reconciling ledgers. It ensures absolute certainty over asset ownership and history. With blockchain’s distributed ledger technology, you don’t need to enter accounting info into multiple databases, reducing the need for auditors to reconcile different ledgers.

Big Data

Big data means large, complex data sets that can be analyzed to reveal patterns and trends. For accounting firms, this opens up new ways to provide clients with accurate and impactful services.

By using big data, you can offer deeper insights into financial trends. This helps businesses make better decisions and stay ahead of the competition.

To get started, firms can use analytical tools that compile financial data into easy-to-read reports. Such tools also come with predictive analytics to forecast future trends, helping clients plan better for the future.

Robotic Process Automation (RPA)

Dealing with repetitive tasks like data entry and reconciliations can be exhausting for accounting professionals. Enter robotic process automation (RPA), an emerging technology transforming the accounting field. RPA tools automate mundane, time-consuming tasks like invoice processing and report generation, making life much easier.

Popular RPA platforms allow professionals to streamline their workflow significantly. For instance, you can set up rules to handle transactions automatically. This means fewer manual entries and more time for strategic tasks. Set up rules in your system, and watch as transactions are processed according to your specifications without lifting a finger.

Optical Character Recognition (OCR)

We all know that handling piles of financial documents can be a pain. But this process has become a lot easier thanks to a technology called optical character recognition (OCR). Now, you can scan your documents and let the software do the work—no need to type out every detail manually.

OCR automates the extraction of text from bills, invoices, and other documents. It also saves time and reduces errors. You can simply scan an invoice, and OCR will pull out all the key details like dates, amounts, and supplier info, then upload it straight to your accounting system.

Accounting Software

Besides handling finances, accounting software now offers a range of advanced features. Gone are the days when it was just for bookkeeping. With innovations like accounting practice management software, you can manage client data, schedule appointments, and oversee document management—all in one place.

Client management software for accountants helps streamline interactions and keeps everything organized. This means less time on admin tasks and more on strategic work.

Cloud-based solutions are also transforming the industry. With cloud document management solutions for accountants, you can securely access and manage important documents from anywhere.

These accounting software advancements enable firms to do more with less, improving both productivity and client service.

Conclusion

If you want to fast-track your path toward modernization, you’ll need to take some measures that go beyond the usual.

Start by investing in training for your team. Look for programs that upskill and keep them ahead with the latest tech and practices.

Having a client-first approach is also a must. Enhancing client engagement allows you to build loyalty and streamline interactions.

Finally, embrace continuous improvement. Review and update processes regularly. A proactive mindset will help you stay agile and maintain modern, efficient operations.

Video

Infographic

Traditional accounting can be challenging, with paperwork, manual calculations, and constant data entry often overwhelming accountants. However, digital advancements are changing the landscape. What technologies are leading the way? Find out more in this infographic.