Running a tax or accounting practice means constantly juggling documents, compliance deadlines, and client expectations. If you’re still handling documents manually or relying on scattered digital storage, you’re likely leaving money on the table. Adopting tax document management software can significantly reduce your operational costs while also improving your team’s efficiency and your clients’ satisfaction.

You might assume that software is just another expense. But in reality, it’s a strategic investment that can pay for itself many times over. The right platform minimizes labor-intensive tasks, eliminates costly errors, and supports a streamlined workflow, all of which contribute directly to your bottom line.

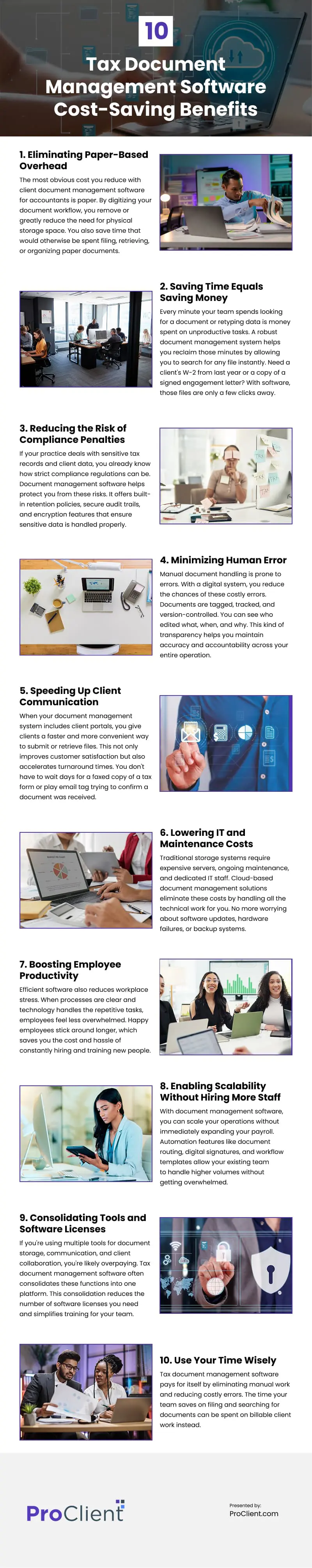

Eliminating Paper-Based Overhead

The most obvious cost you reduce with client document management software for accountants is paper. When you’re printing, storing, mailing, or shredding documents daily, the expenses add up. From purchasing reams of paper and toner to maintaining printers and file cabinets, these small costs accumulate silently in the background.

By digitizing your document workflow, you remove or greatly reduce the need for physical storage space. You also save time that would otherwise be spent filing, retrieving, or organizing paper documents. Instead of paying for storage units or additional office space just to hold paper, you can invest in growth-oriented areas like client acquisition or employee development.

Saving Time Equals Saving Money

Every minute your team spends looking for a document or retyping data is money spent on unproductive tasks. A robust document management system helps you reclaim those minutes by allowing you to search for any file instantly. Need a client’s W-2 from last year or a copy of a signed engagement letter? With software, those files are only a few clicks away.

Think about how much time you spend chasing down missing information or following up with clients via email. Now imagine that every file is automatically categorized, securely stored, and accessible from a central location. Your team spends less time hunting down documents and more time on billable work.

Reducing the Risk of Compliance Penalties

If your practice deals with sensitive tax records and client data, you already know how strict compliance regulations can be. Mistakes like storing documents improperly or missing a retention deadline can lead to hefty fines or reputational damage.

Document management software helps protect you from these risks. It offers built-in retention policies, secure audit trails, and encryption features that ensure sensitive data is handled properly. Besides saving potential legal fees, this helps preserve your credibility and protect future revenue.

Minimizing Human Error

Manual document handling is prone to errors. Misfiled documents, lost files, or incorrect data entries can delay your workflow and damage client trust. And every time your team has to correct a mistake, that’s more labor cost you didn’t plan for.

With a digital system, you reduce the chances of these costly errors. Documents are tagged, tracked, and version-controlled. You can see who edited what, when, and why. This kind of transparency helps you maintain accuracy and accountability across your entire operation.

Speeding Up Client Communication

When your document management system includes client portals, you give clients a faster and more convenient way to submit or retrieve files. This not only improves customer satisfaction but also accelerates turnaround times. You don’t have to wait days for a faxed copy of a tax form or play email tag trying to confirm a document was received.

Clients can upload files directly into your system, where they’re instantly categorized and ready for review. That speed means you can complete more projects in less time, leading to higher revenue potential.

Lowering IT and Maintenance Costs

Traditional storage systems require expensive servers, ongoing maintenance, and dedicated IT staff. Cloud-based document management solutions eliminate these costs by handling all the technical work for you. No more worrying about software updates, hardware failures, or backup systems.

Cloud storage also lets your team work from anywhere. You can access files from home, the office, or while traveling without being stuck at a specific computer. This flexibility makes remote work possible and can even reduce your office space needs, saving you money on rent and utilities.

Boosting Employee Productivity

Software automates repetitive tasks like data entry, filing, and scheduling, which frees up your team’s time. Instead of manually organizing documents or chasing down client information, they can focus on higher-value work like tax planning and business consultations.

Efficient software also reduces workplace stress. When processes are clear and technology handles the repetitive tasks, employees feel less overwhelmed. Happy employees stick around longer, which saves you the cost and hassle of constantly hiring and training new people.

Enabling Scalability Without Hiring More Staff

As your client base grows, you typically face a crossroads: do you hire more staff or invest in smarter systems? With document management software, you can scale your operations without immediately expanding your payroll.

Automation features like document routing, digital signatures, and workflow templates allow your existing team to handle higher volumes without getting overwhelmed. This scalability is key to keeping your margins healthy while your revenue grows.

Consolidating Tools and Software Licenses

If you’re using multiple tools for document storage, communication, and client collaboration, you’re likely overpaying. Tax document management software often consolidates these functions into one platform. This consolidation reduces the number of software licenses you need and simplifies training for your team.

Fewer tools also mean fewer compatibility issues and less time spent toggling between platforms. That saves both time and frustration, while helping your team focus on delivering quality service.

Use Your Time Wisely

Tax document management software pays for itself by eliminating manual work and reducing costly errors. The time your team saves on filing and searching for documents can be spent on billable client work instead.

If you’re still managing documents manually, calculate how many hours your team spends each week on filing, searching, and organizing paperwork. That’s time you could be earning revenue or serving more clients.

Video

Infographic

Accuracy and compliance are essential in tax and accounting practices, but traditional paper-based processes often hinder profitability and efficiency. Tax document management software enhances recordkeeping, reduces operational costs, and streamlines workflows. Explore this infographic to discover its cost-saving benefits.