No matter how efficient you are in your tax service, there is one aspect of the job over which you have no control–the clients. The world’s best accountants are left twiddling their thumbs without the necessary documents from their clients.

With the old process, you spent hours calling and reminding clients to bring in paperwork each week. Clients become less profitable with every phone call and email. You’re using your valuable time on busywork. With the right client document management software, however, you can automate busywork so you can spend your time on more profitable activities.

(djvstock/Freepik)

Common Client Document Challenges

When it comes to client documents, here are some common problems tax professionals run into:

- Clients lose the details of what documents they need to get you.

- Clients don’t prioritize the time to get you the documents.

- Clients forget to bring documents to their appointments.

- Difficulties getting missing information or signatures electronically.

- Having to manage access to client files securely.

- Making all forms and documents available to the client.

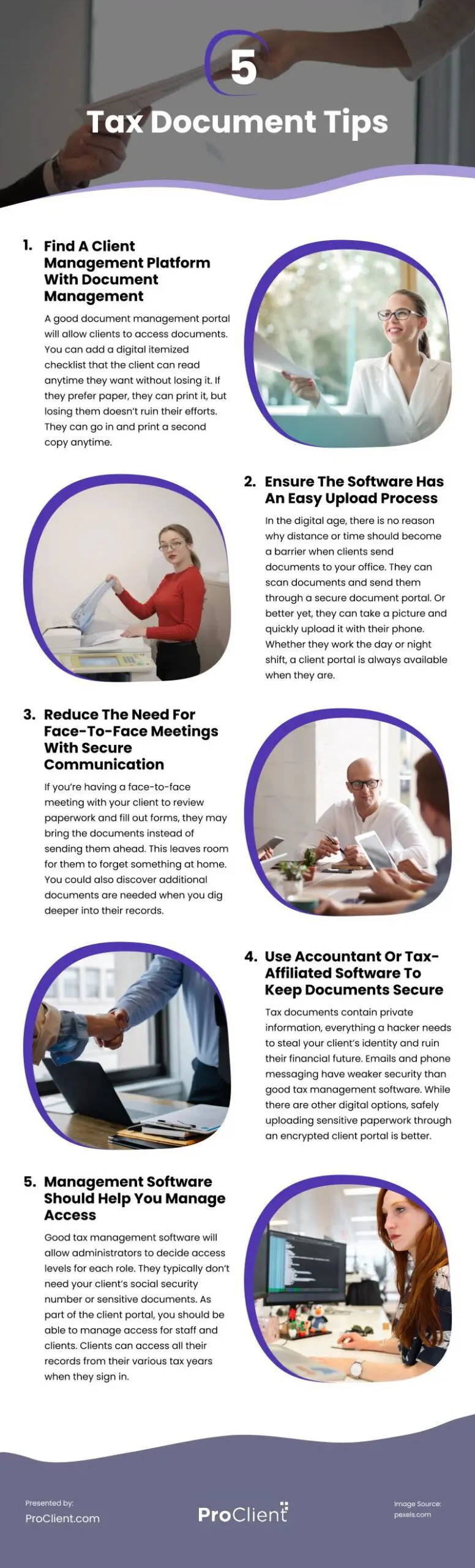

Here are five tips on overcoming the most common document roadblocks to your business’ productivity:

1. Find A Client Management Platform With Document Management

A good document management portal will allow clients to access documents. You can add a digital itemized checklist that the client can read anytime they want without losing it. If they prefer paper, they can print it, but losing them doesn’t ruin their efforts. They can go in and print a second copy anytime.

2. Ensure The Software Has An Easy Upload Process

In the digital age, there is no reason why distance or time should become a barrier when clients send documents to your office. They can scan documents and send them through a secure document portal. Or better yet, they can take a picture and quickly upload it with their phone. Whether they work the day or night shift, a client portal is always available when they are. They can upload and send documents anytime.

3. Reduce The Need For Face-To-Face Meetings With Secure Communication

If you’re having a face-to-face meeting with your client to review paperwork and fill out forms, they may bring the documents instead of sending them ahead. This leaves room for them to forget something at home. You could also discover additional documents are needed when you dig deeper into their records.

You can send them a message through the portal reminding them of the paperwork they forgot to bring so it’s there when your client gets home or to the office and can access them. You can also automate reminders to go out every few days until they upload the proper documents.

Secure messaging through the portal is safer than email and more lasting than a phone call. You can use an electronic signature function on the documents and review them together through video calls or secure chats if necessary.

4. Use Accountant Or Tax-Affiliated Software To Keep Documents Secure

Tax documents contain private information, everything a hacker needs to steal your client’s identity and ruin their financial future. Emails and phone messaging have weaker security than good tax management software. While there are other digital options, safely uploading sensitive paperwork through an encrypted client portal is better. Tax software must meet industry security standards, which are more stringent than email, social network, or phone security.

5. Management Software Should Help You Manage Access

Good tax management software will allow administrators to decide access levels for each role. For example, if you have a receptionist, they should at least have access to:

- The client’s phone number to set appointments.

- The shared calendar, so they don’t double book time slots.

- The person handling their account if you have partners.

They typically don’t need your client’s social security number or sensitive documents. As part of the client portal, you should be able to manage access for staff and clients. Clients can access all their records from their various tax years when they sign in. Clients you have for multiple years should be able to find their taxes from three years ago as easily as the current return you are preparing.

Overall, you can make it as easy as possible for your clients (and yourself) if you utilize tax business document management with a client portal. Automated reminders and checklists keep you from spending unnecessary time on the phone or emailing reminders to forgetful clients. And you can be confident that all documentation remains safe and secure behind layers of digital protection while still being accessible to everyone who needs it.

Video

Infographic

For tax professionals, clients not providing necessary documents can be frustrating. This can hamper productivity and efficiency. To improve productivity, discover five tips to overcome these common document roadblocks in this infographic.