Thousands of accountants and tax professionals stay stuck in manual processes, often because “that’s just how we’ve always done it” or because changing systems feels too risky. Plenty of practices spend hours every week manually entering data, chasing client documents, and updating endless spreadsheets. It’s a common trap that keeps you working in your business instead of on it.

So what exactly should you be automating in your accounting practice? Let’s dive into the tasks that are probably stealing most of your time right now.

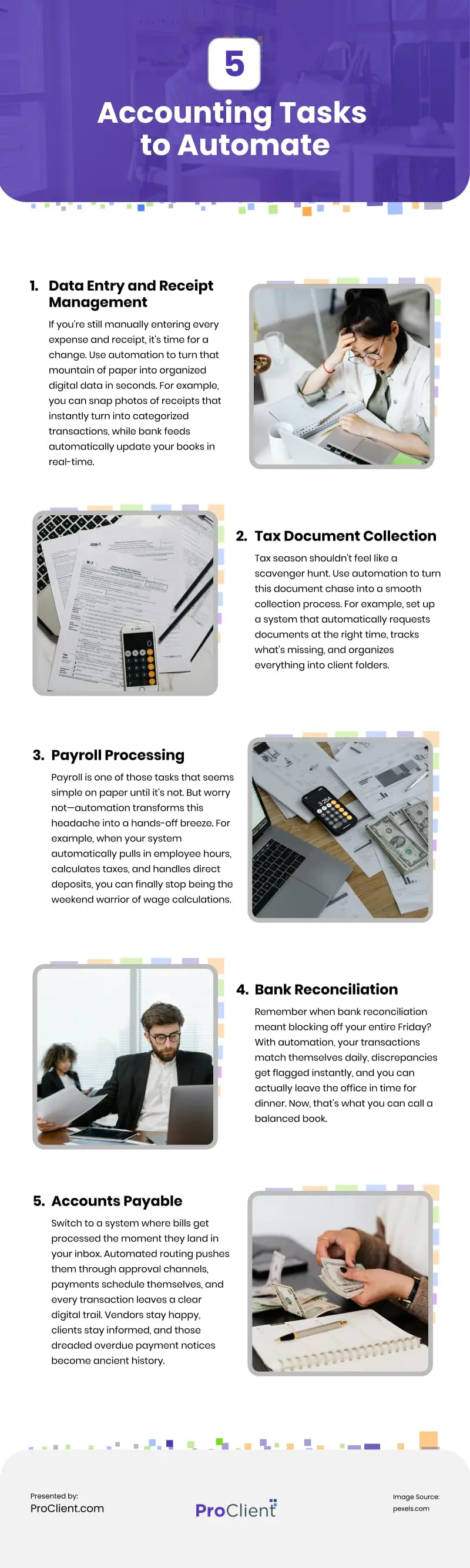

The Top 5 Tasks You Should Consider Automating

1. Data Entry and Receipt Management

If you’re still manually typing in every expense, receipt, and transaction into your accounting practice management software, we need to talk. Your evenings deserve better than spending hours squinting at crumpled receipts and trying to decipher coffee-stained invoices.

Use automation to turn that mountain of paper into organized digital data in seconds. For example, you can snap photos of receipts that instantly turn into categorized transactions, while bank feeds automatically update your books in real-time.

Other ways automation eliminates manual data entry:

- The software matches bank transactions with receipts and invoices (no more “Which expense was this?”)

- It can create rules to categorize recurring transactions.

- The software will flag unusual spending patterns before they become problems.

2. Tax Document Collection

Tax season shouldn’t feel like a scavenger hunt. Yet here you are, digging through emails with subject lines like “Tax Docs (Final)(Really Final)(No Really This Time)” and trying to figure out which clients still need to send in their W-2s.

Use automation to turn this document chase into a smooth collection process. For example, set up a system that automatically requests documents at the right time, tracks what’s missing, and organizes everything into client folders. No more spreadsheets tracking who sent what—your system does it for you.

3. Payroll Processing

Payroll is one of those tasks that seems simple on paper until it’s not. From chasing down employee hours to navigating overtime rules, what starts as basic math quickly spirals into an all-weekend number-crunching festival. And let’s face it—calculating taxes and deductions across multiple clients is about as fun as a root canal.

But worry not—automation transforms this headache into a hands-off breeze. For example, when your system automatically pulls in employee hours, calculates taxes, and handles direct deposits, you can finally stop being the weekend warrior of wage calculations.

Other ways accounting automation software saves your sanity:

- It processes multiple client payrolls simultaneously with different pay schedules.

- The software keeps up with tax rates and compliance automatically.

- It can track benefits, PTO, and deductions accurately for every employee.

4. Bank Reconciliation

Remember when bank reconciliation meant blocking off your entire Friday? That magical time when you’d stare at two screens, playing spot the difference between your books and bank statements until your eyes crossed? Yeah, those were not the good old days.

Make those marathon reconciliation sessions history. With automation, your transactions match themselves daily, discrepancies get flagged instantly, and you can actually leave the office in time for dinner. Now, that’s what you can call a balanced book.

5. Accounts Payable

Open your email. Count the unread vendor bills. Multiply that by your number of clients. Feeling queasy yet? Most practices juggle hundreds of bills monthly, each with its own approval chain and payment timeline. And somehow, despite your best planning, there’s always that one urgent invoice that appears out of nowhere.

Switch to a system where bills get processed the moment they land in your inbox. Automated routing pushes them through approval channels, payments schedule themselves, and every transaction leaves a clear digital trail. Vendors stay happy, clients stay informed, and those dreaded overdue payment notices become ancient history.

Bonus Task: Client Communication

Managing client deadlines and updates might be the quietest time thief in your practice. Don’t believe us? Just check how many times you’ve answered “When is this due?” today, or count the sticky notes with client reminders covering your monitor. Between tax deadlines, document requests, and status updates, you’re practically running a one-person call center.

Stop playing receptionist and let accounting client portal software streamline client interactions. It creates a central hub where clients can view their deadlines, requirements, and document statuses instantly. Automated reminders keep clients up-to-date and on track without needing constant follow-ups.

Other ways automation keeps communication flowing:

- The software also includes an automated text messaging system for accountants that sends customized reminders for upcoming deadlines and requirements.

- It provides secure document sharing with automatic confirmation.

- The software can create a searchable record of all client interactions and updates.

Making the Switch to Automation

Now that you’ve seen the manual tasks consuming your valuable time, you might wonder where to start. The good news? You don’t need to automate everything at once. Most accounting practices find success by starting with one task that causes the biggest headaches and gradually expanding from there.

Look for software that integrates seamlessly with your current tools and streamlines these key tasks. The best solutions prioritize security, stay current with tax laws, and offer reliable support throughout your transition.

Remember, automation lets accountants like you spend less time on repetitive tasks and more time advising clients and building stronger relationships. Every hour saved through automation is an hour you can reinvest in growing your practice.