As a professional serving clients, your schedule is at the heart of your business. But sometimes, the unexpected happens—a meeting overlaps, software glitches, or even personal obligations force you to adjust your planned appointments.

Rescheduling might feel like a hassle, but it doesn’t have to harm your client relationships. When done right, it can show professionalism and respect for their time.

This guide will explore practical ways to reschedule appointments while maintaining trust and efficiency in your tax preparation business.

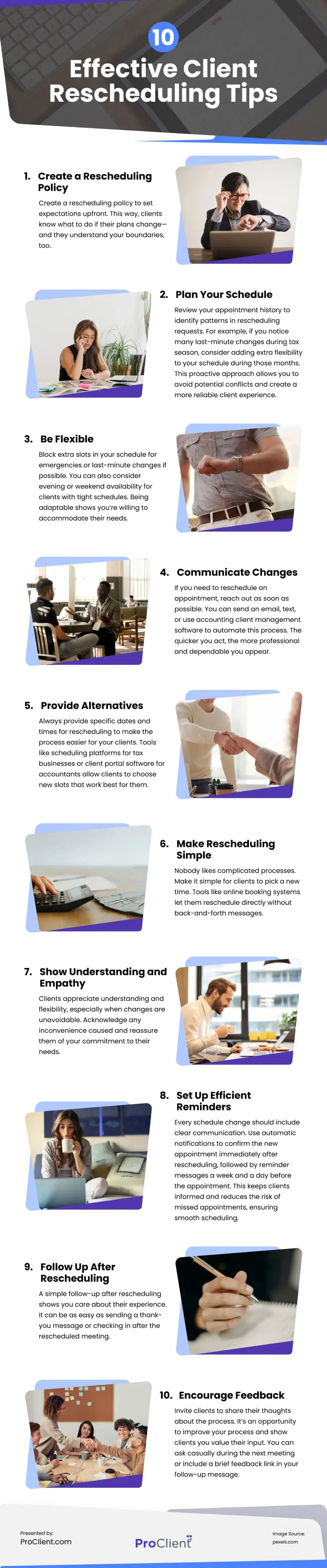

10 Tips for Effective Client Rescheduling

1. Create a Rescheduling Policy

Create a rescheduling policy to set expectations upfront. This way, clients know what to do if their plans change—and they understand your boundaries, too.

Your policy should outline:

- How far in advance they need to reschedule

- Any fees involved for last-minute changes

- Where they can manage their appointments

2. Plan Your Schedule

Review your appointment history to identify patterns in rescheduling requests. For example, if you notice many last-minute changes during tax season, consider adding extra flexibility to your schedule during those months.

This proactive approach allows you to avoid potential conflicts and create a more reliable client experience.

3. Be Flexible

Flexibility goes a long way when rescheduling. Clients appreciate it when you can offer options that fit their busy lives.

Block extra slots in your schedule for emergencies or last-minute changes if possible. You can also consider evening or weekend availability for clients with tight schedules. Being adaptable shows you’re willing to accommodate their needs.

4. Communicate Changes

If you need to reschedule an appointment, reach out as soon as possible. Prompt communication shows respect for your client’s time and allows them to adjust their schedule.

You can send an email, text, or use accounting client management software to automate this process. The quicker you act, the more professional and dependable you appear.

5. Provide Alternatives

Always provide specific dates and times for rescheduling to make the process easier for your clients. Tools like scheduling platforms for tax businesses or client portal software for accountants allow clients to choose new slots that work best for them.

For example, you could say, “I’m available on Wednesday at 2 PM or Thursday at 10 AM. Let me know if either of these works for you.” Offering options shows you’re proactive and considerate.

6. Make Rescheduling Simple

Nobody likes complicated processes. Make it simple for clients to pick a new time. Tools like online booking systems let them reschedule directly without back-and-forth messages.

When sending rescheduling requests, include:

- A link to your updated calendar

- A few specific time options

- Instructions on how to confirm their new slot

7. Show Understanding and Empathy

Clients appreciate understanding and flexibility, especially when changes are unavoidable. Acknowledge any inconvenience caused and reassure them of your commitment to their needs.

For instance, “I understand rescheduling may be inconvenient, and I truly appreciate your flexibility. I’ll ensure everything runs smoothly at our next meeting.” Small gestures like this build trust and show you care about their time.

8. Set Up Efficient Reminders

Every schedule change needs clear communication. Set up automatic notifications to confirm the new appointment time immediately after rescheduling.

Follow this with reminder messages a week before and again a day before the appointment. This simple system helps prevent missed appointments and keeps everyone in sync.

Most modern scheduling tools can handle these reminders automatically, saving you time while maintaining consistent client communication.

9. Follow Up After Rescheduling

A simple follow-up after rescheduling shows you care about their experience. It can be as easy as sending a thank-you message or checking in after the rescheduled meeting.

For example: “Thank you for understanding about the change in our schedule! I’m glad we could find a time that works. Feel free to reach out if you need anything else.”

10. Encourage Feedback

Invite clients to share their thoughts about the process. It’s an opportunity to improve your process and show clients you value their input.

You can ask casually during the next meeting or include a brief feedback link in your follow-up message. For instance:

“If you have a moment, I’d love to hear your thoughts about my rescheduling process. Your feedback helps me improve and better serve you.”

Streamline Your Rescheduling Process

After setting up a clear rescheduling system, the next step is to manage those appointments efficiently. There are two ways to do this:

- The Traditional Approach

Where you keep things manual, you’ll manage a calendar or spreadsheet of your appointments, store email templates in your drafts, and handle reminders yourself. You’ll also need to log client changes and send individual confirmation emails. - Using Client Scheduling Software for a Tax Business

Taking a different route, this lets clients pick new times themselves through your booking link, sends automatic notifications, and keeps all your calendars in sync. The software also handles those helpful extras like appointment reminders and avoiding double bookings.

Overall, while both approaches can work for your practice, scheduling software reduces manual tasks and helps prevent common booking mistakes. There will certainly be times when you need to reschedule client appointments, and how you handle these changes can strengthen or strain your client relationships.

Use the above 10 tips to create a smooth rescheduling process, maintain clear communication, and show your clients you value their time. With an effective system in place, you’ll turn potentially stressful schedule changes into opportunities to demonstrate your professionalism.

Video

Infographic

Rescheduling appointments can be inconvenient, but it doesn’t have to hurt client relationships. Done correctly, it shows professionalism and respect for their time. This infographic offers practical strategies for effective rescheduling while maintaining trust and efficiency in your tax preparation business.