According to the Bureau of Labor Statistics, 20% of businesses fail in the first two years. Roughly 45% fail by the fifth year. Competition for market share is steep. It all adds up: rent, utilities, payroll, taxes, office supplies, and technology. Small businesses need a larger advertising budget and a longer reach. Small business owners wear too many hats, get too little rest, and have less wiggle room in their finances to sustain them through recessions. They need every advantage they can get.

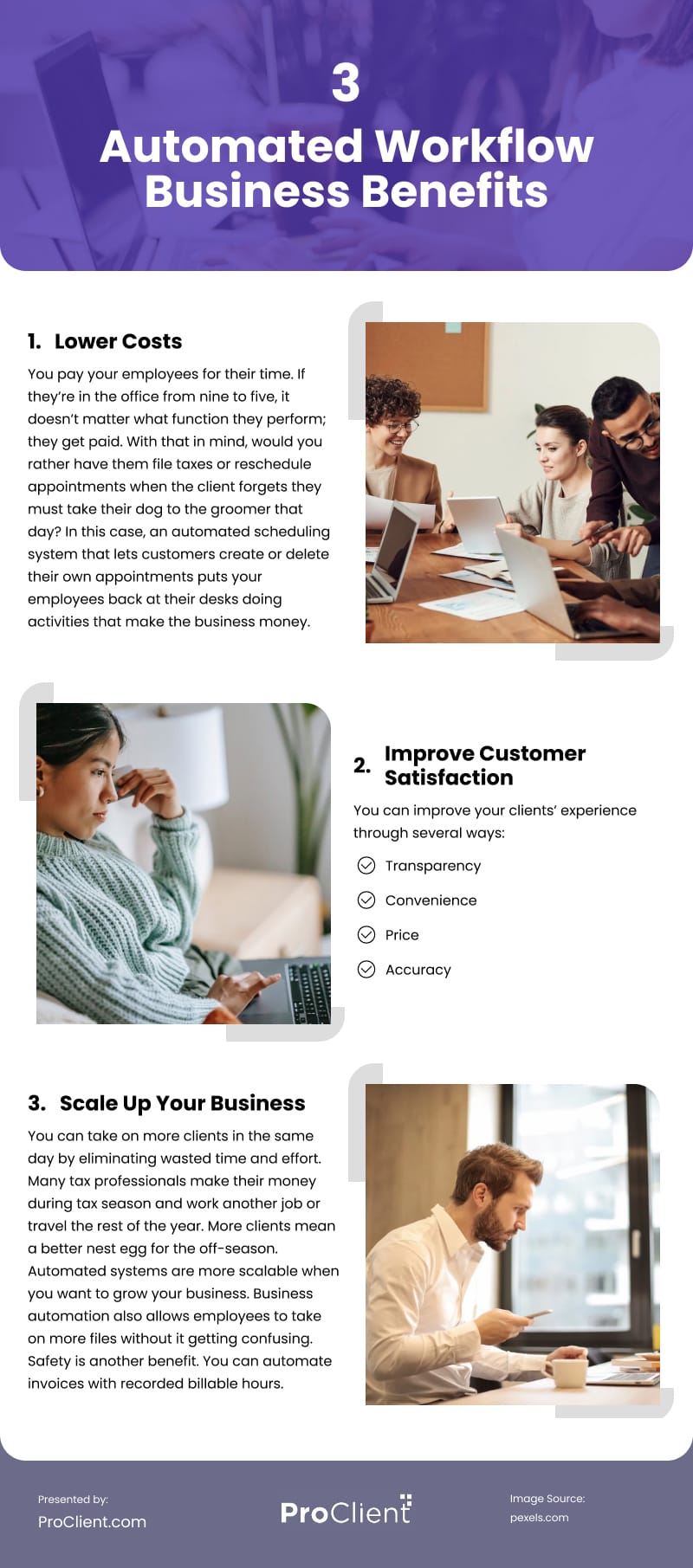

Automated workflows have many benefits that give small businesses an edge. Finding the tax management software with the right automation for your business can lower costs, improve customer satisfaction, and allow you to take on more business with your current resources without sacrificing quality. Here’s a bit more about those benefits:

(Pavel Danilyuk/ pexels)

Lower Costs

You pay your employees for their time. If they’re in the office from nine to five, it doesn’t matter what function they perform; they get paid. With that in mind, would you rather have them file taxes or reschedule appointments when the client forgets they must take their dog to the groomer that day?

In this case, an automated scheduling system that lets customers create or delete their own appointments puts your employees back at their desks doing activities that make the business money.

Likewise, playing phone tag when a client forgets a piece of documentation, needs to sign a document, or is afraid to send documentation via email (which is dangerously vulnerable) can be frustrating and costly.

With good tax client management, they can take a picture of the document with their phone and submit it through a secure encrypted program that protects them from malicious hackers. They can sign a document on their lunch break when they get your text without taking time away from their jobs, kids, or hobbies.

Improve Customer Satisfaction

You can improve your clients’ experience through several ways:

1. Transparency

In today’s digital world, clients have information at their fingertips with a click of a button or a tap on a screen. A document management system with a client portal allows them to track your progress, immediately know if you need additional information, and see the completed documents at will.

2. Convenience

Clients no longer have to take time off work or find babysitters for face-to-face appointments. With video conferences, you can bring in clients from all across the state. Distance, travel time, and lost wages are no longer a barrier.

They can upload, sign, or receive documents any time, day or night, using a good document manager for tax preparation. Connecting can be difficult if a client sleeps during the day and works a night shift, but the client portal never sleeps.

They have a written record of any messages, document requests, or questions they must answer. The message doesn’t get lost on the back of a receipt because they got your call while shopping with three kids.

3. Price

By paying a small price for automation software, you can be more productive with your time. You can pass this time-saving along to your clients. For example, if you bill by the hour, the client isn’t getting charged for wasted time. Even if you don’t charge hourly, you can see more clients with your new, automated efficiency, so you can afford to price more competitively, thus earning more clients and more income per tax season.

4. Accuracy

Automated systems streamline tasks, prefill forms with repeated information, and give error messages if the answer doesn’t match what the computer expects. Tax professionals can work long hours during tax season. Being human, they can make mistakes. Automated systems add another layer of protection for you, your business, your employees, and the client.

Scale Up Your Business

You can take on more clients in the same day by eliminating wasted time and effort. Many tax professionals make their money during tax season and work another job or travel the rest of the year. More clients mean a better nest egg for the off-season.

Automated systems are more scalable when you want to grow your business. For example, you can send mass reminders to your clients before tax season that give them a list of required documents. Automated appointment reminders for the following year will improve repeat business.

Business automation also allows employees to take on more files without it getting confusing. Papers aren’t in the wrong folder or fall behind a desk. Employees can also set reminders for themselves or tag incomplete documents, so they know exactly where they are on each file when they open it.

Safety is another benefit. You can automate invoices with recorded billable hours. Payments through the client portal can be deposited directly into the business account. There will be no cash in the office or late-night bank runs, making it safer for everyone in your office.

If you’re still on the fence, the right automated software will save you time, money, and effort while giving you an edge over other small tax preparation businesses. It will help you grow your business while improving customer satisfaction.

Infographic

Small businesses face challenges, often failing within a few years. Automation is essential for efficient resource management and customer satisfaction. Automated scheduling and client portals streamline operations and enhance security. Embracing automation empowers small tax businesses to thrive, ensuring long-term success in competitive markets by optimizing efficiency and fostering trust with clients.

Video